🔴 Young People Are Having An Awful Time With Finances (And It's Not Their Fault)

Do you resonate with the thought that young people are having a hard time “getting ahead” right now?

Maybe it’s just me, but it seems like you’re barely keeping your head above water unless you’re working in tech or finance. That must be why so many people are looking for a guy in finance. 6’5”. Blue eyes. Trust fund.

Jokes aside, I remember the importance of college drilled into me as early as elementary school.

Millennials and Gen Z were told from a young age that good grades meant college. We were told college meant security. Once we completed college, however, we discovered that only 17% of job listings mention a college degree at all and our student loans are causing more financial insecurity than just about any other life path outside of gambling or drug addiction.

There’s something especially gross about encouraging 18-year-old kids to pick a long-term career path and curate an experience that results in a mountain of debt. It feels like the entrapment of a generation for the benefit of the shareholders of the university.

To be a bit less grim, many young people were told college was a good investment, but the truth is, for many people entering the workforce today, it isn’t.

It’s not just college. Wages are growing much slower than the cost of living, which is straining young people beginning their financial journey. Young people don’t have decades of investment opportunities to help them weather the storm like the older generations do.

I recently watched a video explaining the financial challenges young people are facing through data.

The screenshots below depict why young people aren’t crazy for thinking the odds are stacked against them.

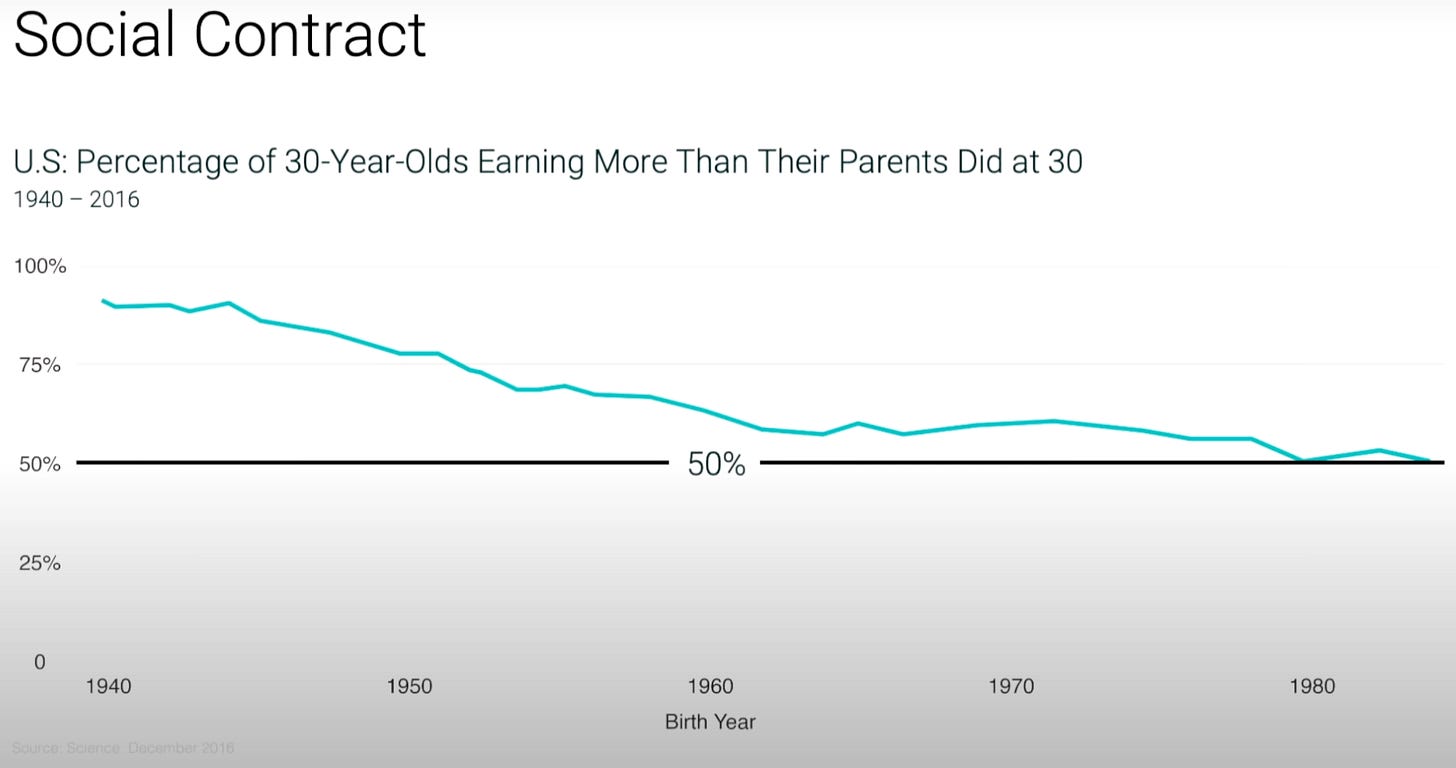

The unwritten “social contract” is that future generations will have a better quality of life than their parents did. Well, for the first time in US history, 50% of 30-year-olds are earning less than their parents did at 30 years old.

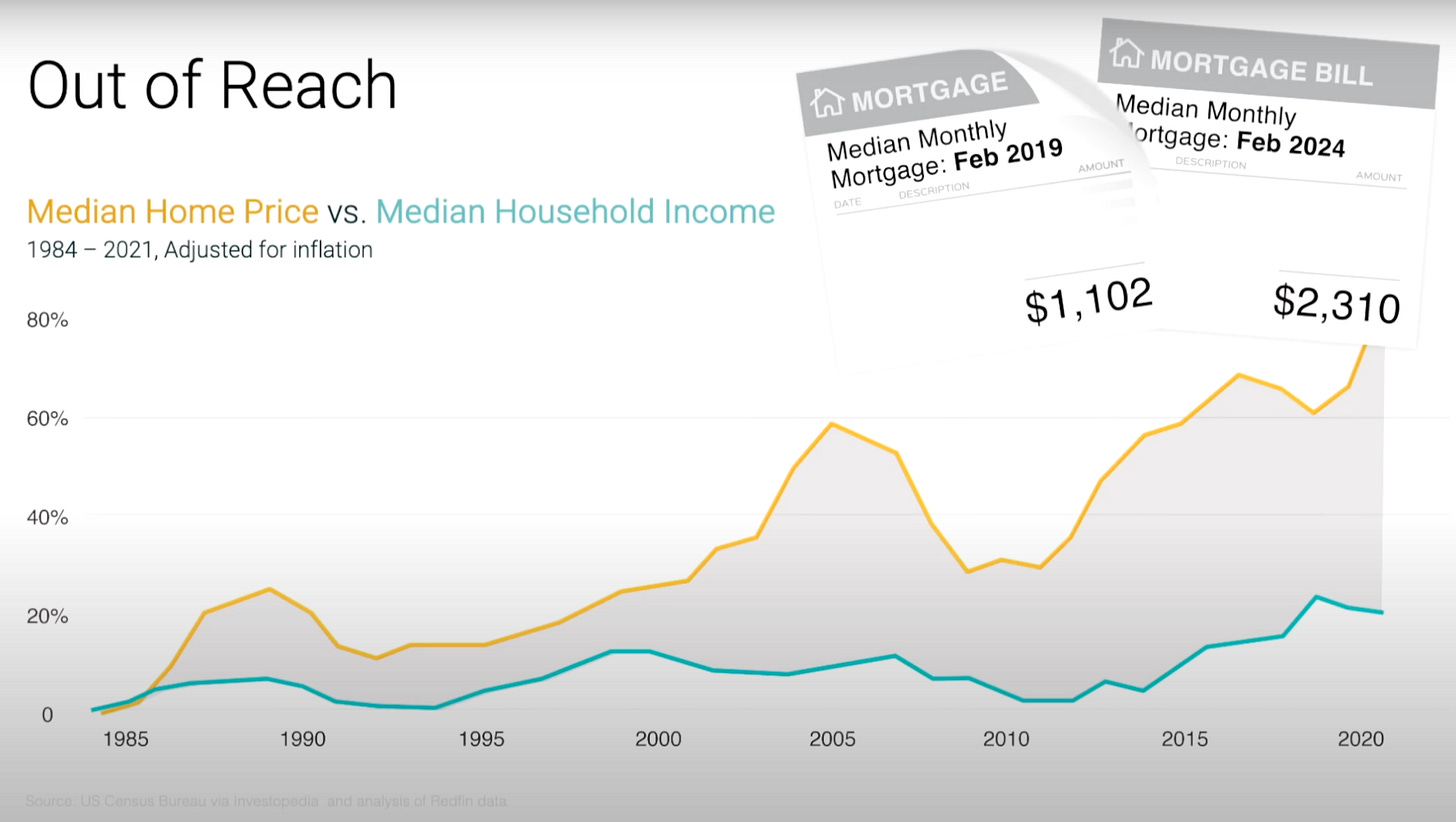

The chart above shows that it’s extremely difficult to buy a house, as the median house home price is growing much faster than the median household income. Additionally, median mortgage bills have doubled over the last five years.

Lastly, 70+ year-olds have been growing their piece of the pie, while the share for people under 40 has shrunk.

So, What Now?

The days of a family becoming wealthy via one income and skyrocketing home equity are over.

The painful truth is that it’s impossible to “get ahead” without being extremely intentional with your finances. Perhaps one day we can change the tide and make life a bit easier for the next generation. Until then, we need to grow our wealth so we have the time and resources to positively impact the next generation.

How? Three things.

Budget

Saving money is the gap between your ego and your income, and wealth is what you don’t see. So wealth is created by suppressing what you could buy today in order to have more stuff or more options in the future. No matter how much you earn, you will never build wealth unless you can put a lid on how much fun you can have with your money right now, today. - Morgan Housel, The Psychology of Money: Timeless lessons on wealth, greed, and happiness

You must spend less than you make if you want a snowball’s chance in hell of building wealth.

Nearly a year and a half ago, I released a free newsletter giving a 3-hour playlist to make budgeting less boring. I highly recommend using an app like NerdWallet to see a full breakdown of your income & expenses automatically. I’ve been using it for nearly a year and I check it nearly daily to ensure I know exactly where my money goes.

If you don’t habitually track your expenses right now, it’s almost guaranteed you’re paying for something you don’t need and don’t even know it

Yes, budgeting and cutting costs suck. But that’s the only way you’re going to have money at the end of the month for the one thing that will get you out of this mess.

Invest

Your leftover money should make money.

If you don’t invest, you will spend your life working for money versus having your money work for you.

I wrote about my mentality when investing for the long term, and why most people don’t have the patience to invest.

Here's the thing about investing...

I don’t know about you, but I’m super excited by compound effort. If you set aside what you want NOW (fast food, new clothes, new apartment) for 10 years, then spend your time and money in areas that grow your opportunity, your life will look incredibly different than it does now.

People don’t invest because there’s no instant reward for doing it. I’d argue that on the surface, investing is not sexy. Just like going to the gym or focusing on your career, it takes years to see results. And that’s boring. However, the alternative is failing to have financial success for yourself and your family.

Good investment advice is often timeless:

Compound interest is your friend. Time in the market is better than timing the market. The stock market tends to outpace inflation when you zoom out enough. Don’t put all your eggs in one basket.

In the past, I’ve had success buying and holding crypto. It’s a young asset class that’s becoming more legitimized and has a lot of opportunities to grow.

But if you want to invest, you must understand what you’re investing in. If you haven’t spent time learning about things like The Halving, miner rewards, and blockchain technology… Now’s a great time to start, as this asset class is like technology and finance had a baby.

You can educate yourself here:

🔴 Here's Why Bitcoin Keeps Coming Back

Bitcoin’s price has followed a similar pattern roughly every four years. This pattern originates from ‘The Halving’ cutting the quantity of new Bitcoin entering circulation in half. In this report, we'll explore: Three different types of money. The halving in simple terms. The halving’s effect on Bitcoin’s price

The article above is my most viewed newsletter by far.

In the article, you’ll learn the history of money, and learn why Bitcoin is an ancient form of money re-invented for the modern age.

Again, highly recommend it. It should be part of a balanced portfolio, and you should never invest what you can’t afford to lose.

Perspective

A great article via visualcapitalist shows the difference in assets between different tires of net worth.

This is one of my favorite charts.

I believe this chart alone can inform a lot about how you manage your investments.

Let’s say you aim to have a net worth of $1,000,000. According to the chart above, most people do it by growing wealth through an IRA, stocks, real estate and equity in company(s).

If you aim to have a net worth of $10,000,000, equity in company(s) tends to be a larger piece of the pie, along with mutual funds and stocks.

The perspective from the chart above can inform how you approach diversity within your investing portfolio.